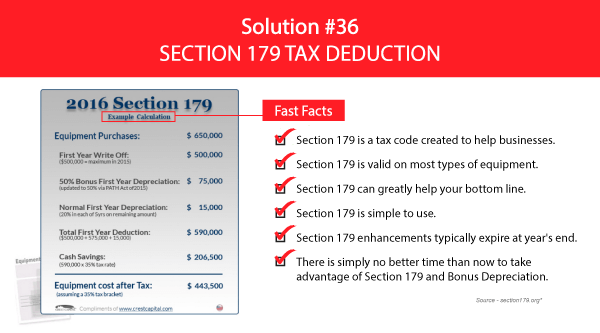

Medley Solutions: Section 179 Tax Deduction

A tax relief for small businesses. “Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment purchased or financed during the tax year. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.“ Click the links to learn more and get the real benefits of purchasing equipment. Take action now before the end of the year.

For More Information:

https://www.irs.gov/publications/p946/ch02.html#en_US_2013_publink1000107410